China vs United States EV Market Analysis

Exploring the World's Two Largest Electric Vehicle Markets

Market Overview

This interactive analysis sets the stage for comparing electric vehicle (EV) markets in China and the United States—the two global leaders in scale and influence. The contrasts in market size, pricing strategies, and consumer adoption reveal distinct pathways to electrification, which are examined in detail through the data and tables that follow.

Global Context

China accounts for over 60% of global EV sales, while the U.S. contributes roughly 8%. Together, they shape the trajectory of global mobility—China through mass accessibility and the U.S. through premium-focused innovation.

Market Dynamics

China's EV sales surpass 11 million units annually, compared to 1.3 million in the U.S.—an 8.5:1 ratio. This scale advantage reflects China’s aggressive policy push and broad offering of affordable options.

Price Philosophy

Average EV prices in China ($15,000-$25,000) are less than half those in the U.S. ($45,000–$55,000), underscoring different strategic approaches and consumer expectations in each market.

Consumer Adoption

EVs represent more than 35% of new car sales in China versus just 7% in the U.S. These adoption curves—shaped by pricing, infrastructure, and cultural readiness—will be further illustrated in the comparative data below.

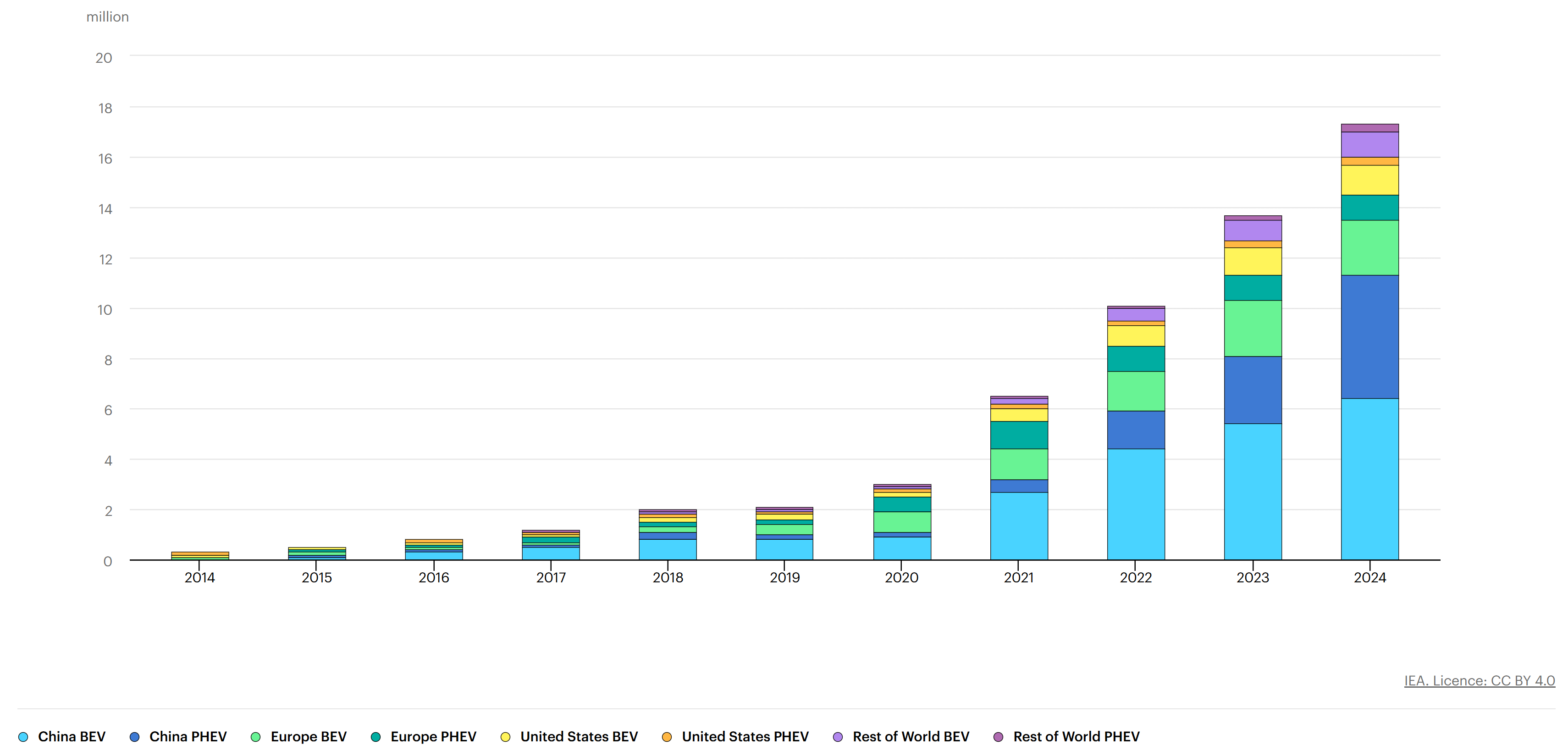

Global BEV vs. PHEV Trends

Market Philosophy Comparison

Two divergent paths to electrification

🇨🇳 China: Mass Accessibility

- Centered on making compact EVs affordable and widely available

- Driven by strong government-led industrial policy

- Rapid build-out of nationwide charging networks

- Wide mix of brands competing (BYD, NIO, XPeng, and more)

- Leading the world in battery tech development

- Production model geared heavily toward exports

🇺🇸 USA: Premium Innovation

- Focused on higher-end SUVs and pickup trucks

- Shaped more by market demand with support from tax incentives

- Charging rollout focused mainly on highway corridors

- Tesla still dominates the EV landscape

- Heavy emphasis on software features and autonomy

- Production mainly aimed at serving the domestic market

Strategic Implications

An analysis of China and U.S. EV trends reveals distinct opportunities and challenges. This section outlines key considerations for investors, manufacturers, and the broader future of global mobility.

For Investors

China's EV market is expanding at a blistering pace (≈11 million units sold vs. ≈1.3 million in the U.S.) with strong penetration (35 % vs. 7 %) - this scale offers exposure to outsized growth if one can navigate competitive risks. In the U.S., the slower pace and premium pricing reduce volatility but also cap upside. Allocating capital across both markets offers a more balanced risk-reward profile.

For Manufacturers

China's model demands ultra-efficient cost structures, economies of scale, and a wide portfolio of affordable models. By contrast, U.S. success hinges on delivering range, features, brand prestige, and addressing consumer concerns around charging and reliability. Manufacturers that can tailor strategies when crossing markets—or modularize product lines—will outperform.

Future Outlook

China is poised to remain the global powerhouse in EV volume, exports, and battery supply chains. The U.S. will continue to lead in software, autonomy, and premium EVs. Over time, these divergent approaches may gradually converge—cheaper, smarter vehicles—shaping the next generation of global mobility.